Make financial advice trustworthy

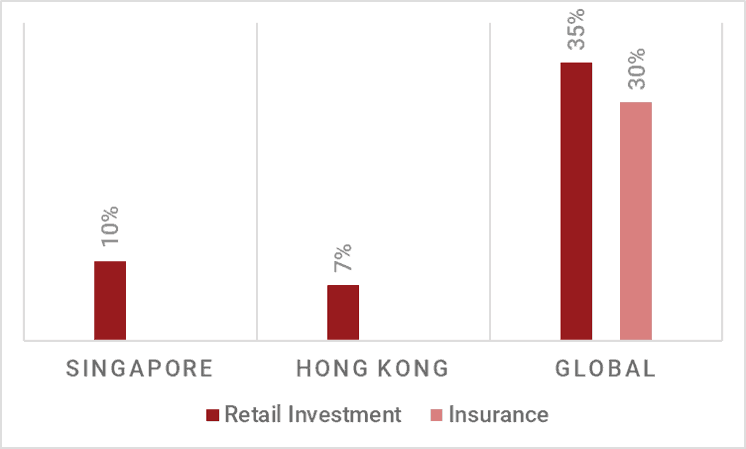

Trust has been elusive in the financial advisory industry. According to the Global Survey on the State of Investor Trust by CFA Institute in 2018 (1), only 10% retail investors in Singapore and 7% in Hong Kong believe that their financial advisers always put their clients first. The global average was 35%. 360F adapted the survey question for insurance and presented it to the financial advisory representatives spread over Asia (2). It turned out that over half the surveyed estimated that globally, less than 30% consumers would believe their agents put themselves first.

Source: (1) Global Survey on the State of Investor Trust, CFA Institute, 2018; (2) Survey: How can the Financial Advisory Industry in Asia serve the Society better?, 360F, 2019

Uncertainty associated with complexity breeds distrust. Most financial products are complex and their returns shrouded by fine print and uncertainty. It is no surprise that consumers find it difficult to trust the advisors who sell these products for a living.

The adviser’s compensation model often comes under fire. After all, it is difficult to trust that an adviser’s product recommendations are unbiased if a successful sale rewards him with hefty sales commissions. Mature markets such as UK and Australia scrap commissions-based compensation model in favour of fee-based advice. The well-intentioned policy backfires as less well-off customer segments are shunned by advisors whose earnings now largely come from managing wealth. In 2017, Schroders reported half the independent financial advisers in UK turned away customers with less than 50,000 pounds to invest. In most parts of the world where fee-based advice is not mandatory, public receptivity is lukewarm at best. After all, financial matters are not life-threatening conditions which one would seek pay for qualified advice without batting an eye. In fact, the younger the adult, the less he or she values financial advice, even though the opportunity costs of not having a sound financial plan are higher. Financial Conduct Authority in UK ([1]) found only 6% millennials paid for financial advice in 2017.

Some markets take the middle ground. They regulate the spread of commissions over multiple years, capping the compensation in the first year. While this discourages hit-and-run sales approach, it does not weaken the association between compensation and product sale. Distrust remains.

Since the compensation models have critical shortcomings, how else can we build trust then?

Instead of focusing entirely on the human advisor, we should pay ample attention to the financial advice itself. Financial advice can be made explicitly trustworthy.

Help consumers evaluate advice

Consumers can trust advisors, albeit the product-based compensation model, if the former can evaluate the latter’s advice easily.

Empowering the consumers is a powerful way of building sustainable trust

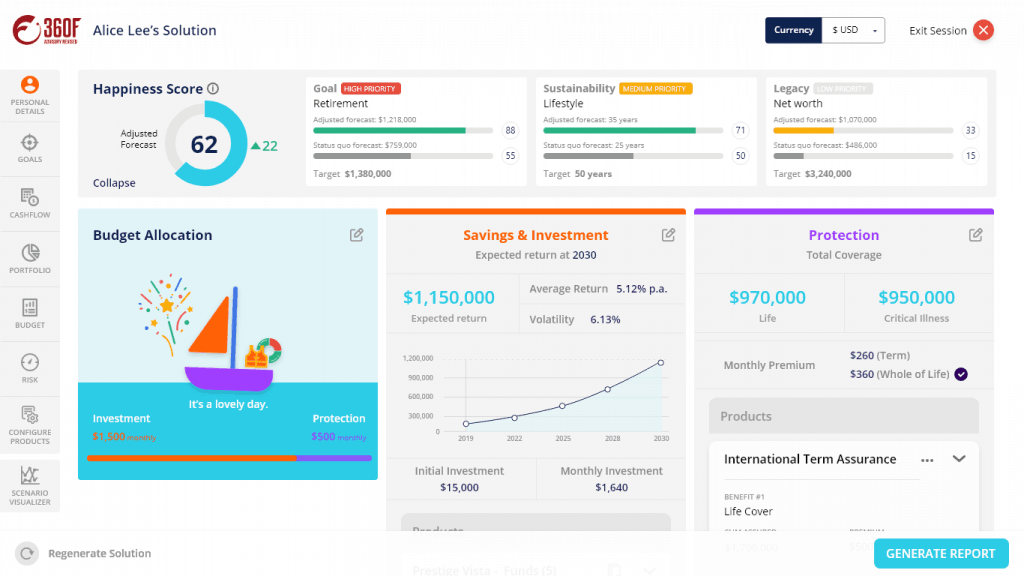

It is unrealistic to expect consumers to understand how the proposed financial product works, but it is very viable to help them understand how the product will impact their financial lives. Consumers and even advisors need not struggle to compare complex product features which render price comparisons meaningless. Instead they can compare the difference the products make. For example, 360F’s HappiU® models the individual’s profile including financial goals, obligations, priorities, constraints and attitudes, enabling a hyper-personalized context to forecast the status quo and recommendations on his/her key financial health indicators which are tangible, easily relatable and even comparable.

Run realistic stress testing

Nothing can inspire more trust than objective facts. The future is unknown but probabilistic planning offers comfort. The 360F modules rely on statistical rigor by simulating millions of insurance-and-investment risk scenarios constructed in the context of the individual’s profile and time horizon. The 360-ProVestment® recommendation engine uses the scenarios to stress test the possible insurance and investment products on the individual’s financial happiness function. HappiU® forecasts the financial health indicators by simulating scenarios exhaustively.

A preview of the 360-HappinessScore® module

We like the doctor with great bedside manners. However, we also expect the doctor to not only have the minimum qualifications, but also the reliable tools that help him measure our vitals, diagnose and monitor our conditions.

We trust the doctor who keeps abreast of the latest technology and medicine innovations and uses them to improve his diagnostic skills, formulate and execute the best viable treatment plans possible.

As a professional, the financial advisor is a financial doctor from whom we expect no less.

Moving forward

Change management will be the main hurdle for financial institutions that aspire to make financial advice trustworthy. In this day and age, financial advisors constantly feel the threat of being displaced by technology. Furthermore, the art of selling tends to overshadow the scientific rigor required behind financial advice. Short of mandating usage and running the risk of backlash, institutions need to structure a change management program that builds up the advisors’ technical knowledge and thus their confidence to use tools that make the transformational difference for their business.

[1] Where millennials turn for financial advice, Financial Times, 2019

Want to discuss more? Drop us an eMail here: clarie.kwa@360f.com